While saving money is not the driving reason behind rightsizing, the process could end up allowing the San Antonio Independent School District to reallocate funds to provide a better education for every student in the district.

SAISD’s goal with rightsizing is to improve educational outcomes for students by providing equitable services across all schools. If the Board of Trustees approves the rightsizing recommendation package on Nov. 13, the school district will be able to align its spending to the number of students in the district instead of the number of buildings, said Chief Financial Officer Dottie Carreon.

“Rightsizing is an attempt to correct some of the inequities that we have within our schools right now, and by making sure that we don’t have overly expensive schools on a per pupil basis, we will be able to redeploy some of those resources to the larger schools that were basically missing those funds. It should produce a more efficient model to where we’re not spending our money on maintaining school buildings instead of educating students,” she said. “If we’re operating far too many buildings and maintaining them, then we’re using up the revenue for each student that should be spent on their education.”

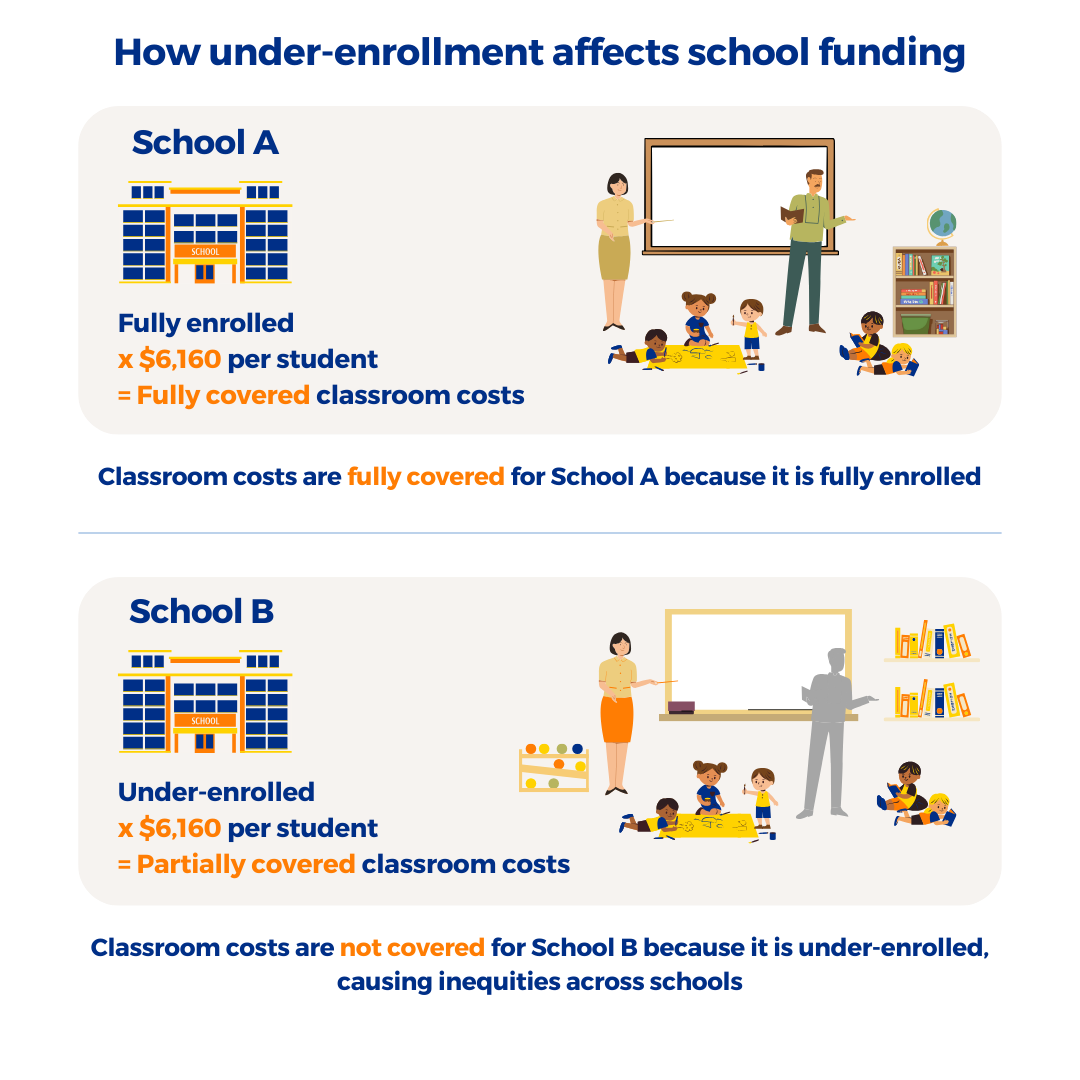

Currently, SAISD redirects some money from schools with a larger student population and sends those funds to schools with smaller student populations. This helps the smaller schools because they are more expensive to operate. Every school, regardless of how many students go there, has the same administrative and operating costs, while schools with more students generate more money.

That creates inequities because not every student has access to the same resources. With rightsizing, SAISD could more equitably fund schools so that every student receives the same benefits, regardless of their school.

So how does Texas fund public schools?

Where do public schools get funds?

In Texas, public schools receive money from two primary sources: local property taxes and state funds.

The state determines how much money school districts receive from both local property taxes and the state, using a formula called the Foundation School Program Formula. This formula calculates how much money school districts need to operate schools, including salaries and supplies.

School districts receive $6,160 for each student in the district, but they get additional funds for students in special education, bilingual education, career and technical education, and gifted and talented programs. Districts may receive more funds for other programs, such as services for students at risk of dropping out of school. The state then uses the Foundation School Program Formula to determine how much funding each school district needs to serve all its students, based primarily on the number of students in the district.

The amount of property wealth in a school district determines how much of its budget is covered by local taxpayers. The more property taxes increase in an area, the more of a school district’s budget is covered by local property taxes instead of the state. The state makes up the difference between the amount the state determines the district will receive and the share of that amount covered by local property taxes.

Why don’t schools get more money if property taxes keep going up?

Property owners have seen a significant increase in their property taxes in recent years, but SAISD does not receive all the money from those tax payments. School districts do not get more money unless state legislators vote to increase the amount of funds that go to schools or if their enrollment increases significantly.

Each time local tax collections increase, the amount of funds SAISD gets from the state decreases, but the overall amount the school district receives does not change. All an increase in property tax collections means is that the state gets to pay less for public schools.

How do school districts use funds?

School district budgets are split into two categories: maintenance & operations and interest & sinking.

Maintenance & operations funds go toward covering the basic operations of public schools, such as salaries for workers, supplies and regular maintenance of facilities. Local property taxes and state funds make up this category of money.

Interest & sinking funds go toward covering the costs associated with paying off debt school districts incur from bonds issued for the construction of new facilities or renovating existing buildings. School districts do not receive revenue from the state to build new facilities, so they must go to voters to pass a bond election to pay for new buildings and upgrades to existing ones. Money from voter-approved bonds go into this account.

What do local property taxes go toward in the school district’s budget?

A school district’s tax rate is split into two categories: maintenance & operations and interest & sinking.

For the 2023-2024 school year, SAISD’s tax rate is $1.20782 per $100 of taxable property value. That tax rate is made up of two rates:

- M&O - $0.75755

- I&S - $0.45027

The M&O rate funds the district’s operations, such as salaries and supplies, and the I&S rate funds the district’s debt service payments, which are used to pay off the bonds voters have approved.

How does Texas compare to how other states fund schools?

Texas ranks 40th in the country for per student spending on public education at $11,005 per student, according to 2021 data from the U.S. Census Bureau. That spending includes revenue from federal, state and local sources. The national average is $14,347.

These are the top 10 states, according to their per student spending:

1. New York – $26,571

2. District of Columbia – $24,535

3. Vermont – $23,586

4. Connecticut – $22,769

5. New Jersey – $22,160

6. Massachusetts – $20,376

7. Alaska – $19,540

8. New Hampshire – $19,443

9. Rhode Island – $18,366

10. Illinois – $18,316

Texas ranks in the bottom 10 nationwide in per-student funding for public education, paying out almost $4,000 below the national average. These figures often change because of new laws that are passed by Congress and the Texas Legislature, changes in enrollment and other factors.

In Texas, state lawmakers have not voted to increase funding for public schools since 2019, and inflation has caused prices to rise significantly since then. Until state lawmakers increase funding for public education, school districts will continue to make tough decisions on where to allocate funds. That impacts teacher pay, campus safety, food and transportation services, and much more.

Así es como Texas financia las escuelas públicas

20 de octubre de 2023

Si bien ahorrar dinero no es la razón principal detrás de la optimización de planteles, el proceso podría terminar permitiendo que el Distrito Escolar Independiente de San Antonio reasigne fondos para brindar una mejor educación a cada estudiante del distrito.

El objetivo de SAISD con la optimización de planteles es mejorar los resultados educativos de los estudiantes brindando servicios equitativos en todas las escuelas. Si la Junta Directiva aprueba el paquete de recomendaciones de ajuste de tamaño el 13 de noviembre, el distrito escolar podrá alinear sus gastos con la cantidad de estudiantes en el distrito en lugar de con la cantidad de edificios, dijo la directora financiera Dottie Carreón.

“La optimización de planteles es un intento de corregir algunas de las desigualdades que tenemos dentro de nuestras escuelas en este momento, y al asegurarnos de que no tengamos escuelas demasiado caras por alumno, podremos redistribuir algunos de esos recursos. a las escuelas más grandes a las que básicamente les faltaban esos fondos. "Debería producir un modelo más eficiente en el que no gastemos nuestro dinero en mantener edificios escolares en lugar de educar a los estudiantes", dijo. “Si operamos demasiados edificios y los mantenemos, entonces estamos agotando los ingresos de cada estudiante que deberían gastarse en su educación”.

Actualmente, SAISD redirige parte del dinero de las escuelas con una población estudiantil más grande y envía esos fondos a escuelas con una población estudiantil más pequeña. Esto ayuda a las escuelas más pequeñas porque su funcionamiento es más caro. Cada escuela, independientemente de cuántos estudiantes asistan, tiene los mismos costos administrativos y operativos, mientras que las escuelas con más estudiantes generan más dinero.

Eso crea desigualdades porque no todos los estudiantes tienen acceso a los mismos recursos. Con la optimización de planteles, SAISD podría financiar escuelas de manera más equitativa para que todos los estudiantes reciban los mismos beneficios, independientemente de su escuela.

Entonces, ¿cómo financia Texas las escuelas públicas?

¿De dónde obtienen fondos las escuelas públicas?

En Texas, las escuelas públicas reciben dinero de dos fuentes principales: impuestos locales a la propiedad y fondos estatales.

El Estado determina cuánto dinero reciben los distritos escolares, tanto de los impuestos locales sobre la propiedad como del Estado, mediante una fórmula denominada Fórmula del Programa Escolar Fundamental. Esta fórmula calcula cuánto dinero necesitan los distritos escolares para el funcionamiento de las escuelas, incluidos salarios y suministros.

Los distritos escolares reciben $6,160 por cada estudiante en el distrito, pero obtienen fondos adicionales para estudiantes en educación especial, educación bilingüe, educación técnica y profesional, y programas para talentosos y sobresalientes. Los distritos pueden recibir más fondos para otros programas, como servicios para estudiantes en riesgo de abandonar la escuela. Luego, el estado utiliza Foundation School Program Formula para determinar cuánto dinero necesita cada distrito escolar para atender a todos sus estudiantes, basándose principalmente en la cantidad de estudiantes en el distrito.

La cantidad de riqueza inmobiliaria en un distrito escolar determina qué parte de su presupuesto está cubierta por los contribuyentes locales. Cuanto más aumenten los impuestos a la propiedad en un área, mayor será la parte del presupuesto de un distrito escolar cubierta por los impuestos locales a la propiedad en lugar del estado. El estado compensa la diferencia entre la cantidad que el estado determina que recibirá el distrito y la parte de esa cantidad cubierta por los impuestos locales a la propiedad.

¿Por qué las escuelas no reciben más dinero si los impuestos a la propiedad siguen aumentando?

Los propietarios han visto un aumento significativo en sus impuestos a la propiedad en los últimos años, pero SAISD no recibe todo el dinero de esos pagos de impuestos. Los distritos escolares no reciben más dinero a menos que los legisladores estatales voten para aumentar la cantidad de fondos que se destinan a las escuelas o si su inscripción aumenta significativamente.

Cada vez que aumentan las recaudaciones de impuestos locales, la cantidad de fondos que SAISD recibe del estado disminuye, pero la cantidad total que recibe el distrito escolar no cambia. Todo lo que significa un aumento en la recaudación de impuestos a la propiedad es que el estado pagará menos por las escuelas públicas.

¿Cómo utilizan los fondos los distritos escolares?

Los presupuestos de los distritos escolares se dividen en dos categorías: mantenimiento y operaciones e intereses y amortizaciones.

Los fondos de mantenimiento y operaciones se destinan a cubrir las operaciones básicas de las escuelas públicas, como los salarios de los trabajadores, los suministros y el mantenimiento regular de las instalaciones. ?Los impuestos locales sobre la propiedad y los fondos estatales conforman esta categoría de dinero.

Los intereses y los fondos de amortización se destinan a cubrir los costos asociados con el pago de la deuda que los distritos escolares incurren por los bonos emitidos para la construcción de nuevas instalaciones o la renovación de edificios existentes. Los distritos escolares no reciben ingresos del estado para construir nuevas instalaciones, por lo que deben acudir a los votantes para aprobar una elección de bonos para pagar nuevos edificios y mejoras a los existentes. El dinero de los bonos aprobados por los votantes entra a esta cuenta.

¿A qué se destinan los impuestos locales a la propiedad en el presupuesto del distrito escolar?

El dinero de los bonos aprobados por los votantes entra a esta cuenta.

Para el año escolar 2023-2024, la tasa impositiva de SAISD es de $1.20782 por cada $100 del valor imponible de la propiedad. Dicho tipo impositivo se compone de dos tipos:

* M&O - $0.75755

* I&S - $0.45027

La tasa M&O financia las operaciones del distrito, como salarios y suministros, y la tasa I&S financia los pagos del servicio de la deuda del distrito, que se utilizan para liquidar los bonos aprobados por los votantes.

¿Cómo se compara Texas a cómo otros estados financian las escuelas?

Texas ocupa el puesto 40 en el país en gasto por estudiante en educación pública con $11,005 por estudiante, según datos de 2021 de la Oficina del Censo de EE. UU. Ese gasto incluye ingresos de fuentes federales, estatales y locales. El promedio nacional es de $14,347.

Estos son los 10 estados principales, según su gasto por estudiante:

1. New York – $26,571

2. District of Columbia – $24,535

3. Vermont – $23,586

4. Connecticut – $22,769

5. New Jersey – $22,160

6. Massachusetts – $20,376

7. Alaska – $19,540

8. New Hampshire – $19,443

9. Rhode Island – $18,366

10. Illinois – $18,316

Texas se ubica entre los 10 últimos a nivel nacional en financiamiento por estudiante para la educación pública, pagando casi $4,000 por debajo del promedio nacional. Estas cifras cambian a menudo debido a nuevas leyes aprobadas por el Congreso y la Legislatura de Texas, cambios en la inscripción y otros factores.

En Texas, los legisladores estatales no han votado para aumentar la financiación de las escuelas públicas desde 2019, y la inflación ha provocado un aumento significativo de los precios desde entonces. Hasta que los legisladores estatales aumenten los fondos para la educación pública, los distritos escolares seguirán tomando decisiones difíciles sobre dónde asignar los fondos. Eso afecta el salario de los maestros, la seguridad del campus, los servicios de alimentación y transporte, y mucho más.